p2p-zaim.ru

Market

Extended Warranty Monthly Payments

Unlimited Mileage, No Waiting Period, Easy Monthly Payments - Get an Online Quote Today in Under 5 Minutes - BBB A+ Rated - Buy Direct & Save. protection for their car after the manufacturer warranties end extended auto warranty cost to your initial loan, making your monthly payments simpler. Flexible pricing. Your monthly cost is based on the year, make, model and mileage of your vehicle. Prices start as low as $99 per month. You can actually lower your upfront costs by setting up a payment plan. You'll make low monthly payments and your warranty will be active immediately. There is no admin fee, no processing fee, no associated fee of any kind. Just choose the ESP coverage that's best for you, put down a small down payment and. The first extended warranty monthly subscription for Canadians. Starting at $/month. No commitment, no paperwork. % online. Our choice of extended warranties from monthly, yearly, 3-year and 5-year pay plans – starting as low as $ per month – give retail customers more. Your monthly cost is based on the year, make, model and mileage of your vehicle. Prices start as low as $99 per month. custom plans. Easy startup. Call us with. Other providers, such as Autopom, offer lower monthly payments for their unlimited plans. extended warranty provider may not pay for repairs. Unlimited Mileage, No Waiting Period, Easy Monthly Payments - Get an Online Quote Today in Under 5 Minutes - BBB A+ Rated - Buy Direct & Save. protection for their car after the manufacturer warranties end extended auto warranty cost to your initial loan, making your monthly payments simpler. Flexible pricing. Your monthly cost is based on the year, make, model and mileage of your vehicle. Prices start as low as $99 per month. You can actually lower your upfront costs by setting up a payment plan. You'll make low monthly payments and your warranty will be active immediately. There is no admin fee, no processing fee, no associated fee of any kind. Just choose the ESP coverage that's best for you, put down a small down payment and. The first extended warranty monthly subscription for Canadians. Starting at $/month. No commitment, no paperwork. % online. Our choice of extended warranties from monthly, yearly, 3-year and 5-year pay plans – starting as low as $ per month – give retail customers more. Your monthly cost is based on the year, make, model and mileage of your vehicle. Prices start as low as $99 per month. custom plans. Easy startup. Call us with. Other providers, such as Autopom, offer lower monthly payments for their unlimited plans. extended warranty provider may not pay for repairs.

monthly finance or lease payment. Plus, you may be entitled to benefits in addition to the basic factory warranty, such as car rental, lodging and meal. There is no admin fee, no processing fee, no associated fee of any kind. Just choose the ESP coverage that's best for you, put down a small down payment and. Extended warranties also typically offer affordable monthly payment monthly vehicle payments if you purchase an extended warranty when you purchase your car. Vehicle protection plans through a car insurer or third party may provide more comprehensive, pay-as-you-go coverage for newer cars than a warranty. Vehicle. Others require a down payment and monthly payments for the entire term of the contract. Many warranty and service contract providers offer multiple coverage. financing available from $ - $, and terms up to 84 months. Auto Loan Calculator Want to know what your monthly auto payment will be? No need to. An extended warranty covers all or some of the cost of certain repairs after the standard factory warranty expires. It may also cover other items such as. VSCs purchased through the dealer /manufacturer can be worked into vehicle financing and reflected in your monthly payments. If bought through an authorized. Have an Auto Loan with us? Your vehicle can be eligible for the Route 66 Extended Warranty without increasing your monthly payment amount! Our loan officers can. No-Haggle, Low-Price, Everyday Guarantee™; Affordable, low monthly payments; 24/7 roadside assistance included; A+ Better Business Bureau rating and trusted. The warranty refund comes off your payoff. What you're figuring has nothing to do with the payoff. The principal on the loan should have dropped. Service Contracts are like health insurance for your car. They can be worked into your financing, so that you pay a small amount monthly to avoid costly repair. Can be included in your monthly payment when bought at purchase of vehicle; Can select coverage needed based on your driving habits; BACKED BY CHRYSLER, NOT a. Everything Breaks is America's fastest growing and most trusted auto, home, and electronics warranty company. We offer protection plans for almost. When you are in the Finance office, you are generally presented with what your overall monthly payment will be with everything included, and that includes an. The cost of your service contract can be purchased separately or easily attached to your monthly payment. Higher Resale Value. Your contract can be. VSCs purchased through the dealer /manufacturer can be worked into vehicle financing and reflected in your monthly payments. If bought through an authorized. It is good to get an extended warranty if you want to maintain your car but can't afford a costly repair but can afford the monthly payment on your auto. Purchase an extended warranty protection plan for your car and repair monthly payment plans, towing service, rental car and trip-interruption benefits. Purchase an extended warranty protection plan for your car and repair monthly payment plans, towing service, rental car and trip-interruption benefits.

Business Ideas To Make A Lot Of Money

In the same vein as a dog-walking service, a delivery or errand-running business doesn't require a lot of upfront cash. You'll just need to print some. I`m a fan of what I call the big four freelance genres: designers, developers, writers, and marketers. I was able to build a successful writing business within. Profitable small businesses include luxury goods, travel and real estate. In a recession, repair and resale retail are more likely to be profitable. If you enjoy photography as a hobby, turn it into a profitable business. Find your niche to help you discover success. If you aren't ready to invest in. Chatbots are necessary for a business to filter queries that need human assistance. Creating chatbots for companies is an excellent business to start now as. A side hustle is anything you do to earn money outside of your day job. However, side hustles carry a more entrepreneurial connotation than merely taking on a. Freelance writing or editing: If you have strong writing or editing skills, you can use them to make money as a freelancer. Websites like Upwork. making a portfolio of social media campaign ideas for well-known brands. You may want to invest your money into creating a website and marketing your business. Affiliate marketing is one of the most lucrative, high-margin, new business ideas in the US, with spending reaching nearly $ billion in To run an. In the same vein as a dog-walking service, a delivery or errand-running business doesn't require a lot of upfront cash. You'll just need to print some. I`m a fan of what I call the big four freelance genres: designers, developers, writers, and marketers. I was able to build a successful writing business within. Profitable small businesses include luxury goods, travel and real estate. In a recession, repair and resale retail are more likely to be profitable. If you enjoy photography as a hobby, turn it into a profitable business. Find your niche to help you discover success. If you aren't ready to invest in. Chatbots are necessary for a business to filter queries that need human assistance. Creating chatbots for companies is an excellent business to start now as. A side hustle is anything you do to earn money outside of your day job. However, side hustles carry a more entrepreneurial connotation than merely taking on a. Freelance writing or editing: If you have strong writing or editing skills, you can use them to make money as a freelancer. Websites like Upwork. making a portfolio of social media campaign ideas for well-known brands. You may want to invest your money into creating a website and marketing your business. Affiliate marketing is one of the most lucrative, high-margin, new business ideas in the US, with spending reaching nearly $ billion in To run an.

Work your business around your full time job. When you have amassed lots of cash and opportunities to tap into credit then you will be ready to go full time. Or. If you are a great writer, know how to build websites, or can create and edit videos, there are unlimited opportunities for work around the web. If you do not. What entrepreneur businesses make the most money · 1. Business Consulting: · 2. Cleaning Services: · 3. Courier Services: · 4. Personal Chef: · 5. Tutoring, both. Businesses that are always in demand · 1. Hairdressers · 2. Tradespeople · 3. Vegan foods and supplies · 4. Funeral services · 5. IT Support. Here are some low-cost business ideas to consider: 1. Freelance Services: Offer your skills as a freelancer in areas like writing, graphic design, web. Miscellaneous cash business ideas · Transportation services · Parking meter services · Parking lot management services · Plant nursery management services · Pet. There's been a lot of talk about big data. But, most people and companies don't have the time to analyze or discuss this information. That's. Similar to a vending machine business, you can earn income by setting up a route of ATMs. When patrons pull out cash, they pay a surcharge to use the machine. Creating and selling online courses is a profitable and scalable business idea for those with expertise in a particular field. You'll probably need to spend $ You can create a child enrichment business centered around a variety of topics: gymnastics, art, music, yoga, swimming the list goes on. In all cases, you'll. When these families go away for extended periods, your pet-sitting small business can give them peace of mind. As a pet sitter, you'll watch over your clients'. Entrepreneurs who are growing their businesses must focus on high-return tasks. They need professionals with good organizational skills to help them run their. Discover the right business to start with our list of the best ideas you can quickly turn into profitable businesses with little to no money make a lot of. Ideas that fall under this section make great businesses. That's because these ideas have the potential to get a lot of customers and command a high price. Jewelry making is a popular and profitable handmade business idea, allowing you to create beautiful and unique pieces that appeal to a wide range of customers. 18 of the best business ideas to start with little money · Dropshipping · Print on demand · Selling on Amazon · Move your brick and mortar store online · Video. Airbnb provides an excellent opportunity for homeowners to make an extra income by monetizing their unused space. Just list your property/room on Airbnb, and. How to generate a money making business idea using an exercise I call “Thrusness”. Grab a piece of paper and make a three-column list. Don't create an Excel or. Tutoring is not only a great way to earn some money on the side, but it's also a very satisfying job. Students of all ages need tutors for math, science. This comprehensive guide provides 50 small business ideas across various industries, offering inspiration and practical insights for aspiring entrepreneurs.

How Do I Request A Credit Freeze

How to place: Contact any one of the three credit bureaus — Equifax, Experian, and TransUnion. You don't have to contact all three. The credit bureau you. If you wish to place or remove a security freeze on your NCTUE account, call or visit p2p-zaim.ru#/. Georgia Attorney. Quick Answer. You can freeze and unfreeze your credit reports at Experian, TransUnion and Equifax online, by phone or by mail. A Security Freeze will be placed on your Innovis Credit Report after your request has been received and your identity has been verified. You will receive a. Freezing your credit file for free is simply a matter of contacting each of the three credit bureaus and requesting a freeze. Yes, but you have to lift the freeze to obtain a new credit card or loan. You can lift it for a period of time, or you can lift it for a specific creditor, or. All consumers can get a free security freeze online, by phone or by mail. A security freeze, also known as a credit or a file freeze, can be lifted (or “thawed. To place a freeze on your credit you need to contact the credit bureaus to request the freeze. It's important to know that there are THREE national credit. Call or login to your account at each credit reporting bureau for instructions on how to allow temporary access to your credit file during a freeze. How do. How to place: Contact any one of the three credit bureaus — Equifax, Experian, and TransUnion. You don't have to contact all three. The credit bureau you. If you wish to place or remove a security freeze on your NCTUE account, call or visit p2p-zaim.ru#/. Georgia Attorney. Quick Answer. You can freeze and unfreeze your credit reports at Experian, TransUnion and Equifax online, by phone or by mail. A Security Freeze will be placed on your Innovis Credit Report after your request has been received and your identity has been verified. You will receive a. Freezing your credit file for free is simply a matter of contacting each of the three credit bureaus and requesting a freeze. Yes, but you have to lift the freeze to obtain a new credit card or loan. You can lift it for a period of time, or you can lift it for a specific creditor, or. All consumers can get a free security freeze online, by phone or by mail. A security freeze, also known as a credit or a file freeze, can be lifted (or “thawed. To place a freeze on your credit you need to contact the credit bureaus to request the freeze. It's important to know that there are THREE national credit. Call or login to your account at each credit reporting bureau for instructions on how to allow temporary access to your credit file during a freeze. How do.

1. Contact TransUnion, Equifax, and Experian online, by phone, or by mail. · 2. Provide all information requested, including your Social Security number. If you're applying for credit – buying a new vehicle, for instance – and you have a security freeze on your credit report, you can temporarily lift the security. How to request an Experian credit freeze · Online: Sign up online to freeze and unfreeze your credit. · By phone: EXPERIAN () · By mail: Send. Call the toll-free fraud number of any one of the three major credit-reporting agencies or make a request online to place an initial fraud alert on your credit. Learn how to apply, lift, or remove a credit freeze on your Equifax Credit Report Download and follow the instructions on the Minor Freeze Request form. You may request a security freeze by contacting Equifax, Experian, and TransUnion individually. You can make your request: online; by certified mail, or; by. To remove the security freeze, temporarily or permanently, contact the credit reporting company where you placed the freeze and provide that personal. You can request your security freeze via phone at Your FCRA Rights (Federal and State). Read about your rights under the Fair Credit Reporting. Unfreezing credit through Experian™, Equifax® or TransUnion ; Online: Experian™ doesn't require you to create an account to lift a credit freeze. Simply fill out. To place a freeze, you must contact each of the three credit bureaus. You can request the freeze by mail. See the sample letters at the end of this sheet for. You should request a credit freeze immediately after you've been a victim of identity theft or if you think your personal information has been accessed, perhaps. Consumers can request a security freeze be placed on their credit report by the three major credit reporting agencies in different ways: by phone, over the. Any Indiana resident can request a credit freeze free of charge. There is no fee for Indiana residents to place, temporarily lift, remove or request a new. Experian: You can place an online freeze through Experian, call the agency at or send a request by mail. TransUnion: Freeze your credit with. The credit bureaus must remove a freeze within 3 business days after receiving a request for removal. What Law Requires Security Freezes for Children Under 16? To place a freeze, you must write to each of the three credit reporting agencies. You must provide identifying information. If you are an identity theft victim. To place a credit freeze, send a request to each of the three credit reporting agencies. You will need to include your personal information, as described below. A credit freeze locks your credit report until you approve its release—making it harder for identity thieves to open new credit accounts in your name. In order to request a credit freeze, expect to provide some or all of the following information to the credit reporting agency, depending on whether you request. If you want to change your freeze over the phone, call us at and we'll verify your identity by asking for your name, date of birth, address and.

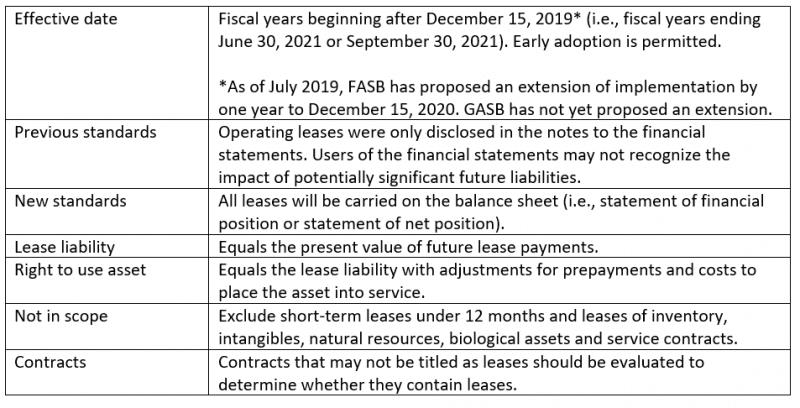

New Gasb Lease Standard

New lease accounting standards for state/local governments and public higher education institutions regulated by GASB (GASB 87) and for the federal government. This new accounting standard compels a shift towards greater transparency and uniformity, ensuring that lease liabilities and assets are reflected more. The new standards are effective from reporting periods starting December 15, and local US governments are required to comply starting July 1, ASC GASB 87 addresses the recognition, measurement, and disclosure of leases for state and local governments, and establishes a single model for lease. To more accurately portray lease obligations and thus, increase the usefulness of governmental financial statements, GASB 87 requires all agreements that meet. The Governmental Accounting Standards Board (GASB) issued Statement No. 87 Leases which establishes a single reporting model for lease accounting to enhance. It will be effective for reporting periods beginning after Dec, Early application of the new GASB lease accounting standard is encouraged. GASB 87 implementation date for municipalities The new lease accounting standard, GASB 87, is meant to boost the usefulness of financial statements for. The new lease accounting standards consist of the statements ASC and GASB 87 & GASB 96 in the US and IFRS 16 internationally. New lease accounting standards for state/local governments and public higher education institutions regulated by GASB (GASB 87) and for the federal government. This new accounting standard compels a shift towards greater transparency and uniformity, ensuring that lease liabilities and assets are reflected more. The new standards are effective from reporting periods starting December 15, and local US governments are required to comply starting July 1, ASC GASB 87 addresses the recognition, measurement, and disclosure of leases for state and local governments, and establishes a single model for lease. To more accurately portray lease obligations and thus, increase the usefulness of governmental financial statements, GASB 87 requires all agreements that meet. The Governmental Accounting Standards Board (GASB) issued Statement No. 87 Leases which establishes a single reporting model for lease accounting to enhance. It will be effective for reporting periods beginning after Dec, Early application of the new GASB lease accounting standard is encouraged. GASB 87 implementation date for municipalities The new lease accounting standard, GASB 87, is meant to boost the usefulness of financial statements for. The new lease accounting standards consist of the statements ASC and GASB 87 & GASB 96 in the US and IFRS 16 internationally.

GASB 87 is the new leasing standard, superseding a number of previous lease accounting standards being: GASB Statement No. Issued in , GASB UPDATE: Due to the COVID pandemic the Governmental Accounting Standards Board (GASB) voted unanimously to delay the implementations of these GASBs for. An in depth look into GASB's new lease standard. GASB Leases. Page 2. ©. 2. 0 on lease accounting and financial reporting (GASB 62). WHEN. – Effective. In June , the Governmental Accounting Standards Board (GASB) issued Statement No. 87,Leases. GASB 87 became effective for fiscal years beginning after June. GASB Statement No. 87, Leases By clicking on the ACCEPT button, you confirm that you have read and understand the GASB Website Terms and Conditions. Do you. Organizations subject to GASB 87 must adopt the new standard for fiscal periods beginning after June 15, However, GASB encourages organizations to apply. Lease classifications (i.e., operating or capital) were based on bright-line criteria such as whether the government leased an asset for more than 75% of its. In June , the Governmental Accounting Standards Board (GASB) issued NEW DEFINITION OF A LEASE. The Statement defines a lease contract as. In , the latest Governmental Accounting Standards Board (GASB) lease accounting standard, GASB 87, began to go into effect for most U.S. state and local. The requirements related to leases, PPPs, and SBITAs are effective for fiscal years beginning after June 15, , and all reporting periods thereafter. The. New York State will implement Governmental Accounting Standards Board Statement (GASBS) 87 - Leases, as well as GASBS 96, Subscription-Based Information. “GASB Statement No. 87 Leases – Part 2” was issued in June and builds on the information provided in Memorandum # This new memorandum focuses on. The new standards are effective from reporting periods starting December 15, and local US governments are required to comply starting July 1, ASC The new standard will require all leases with lease terms exceeding one year to be recognized as both a “right-of-use” asset and a lease liability on the. The Governmental Accounting Standards Board (GASB) issued Statement No. 87 Leases which establishes a single reporting model for lease accounting to enhance. The new guidance will increase the comparability and usefulness of information and reduce complexity for preparers. GASB 87 aligns with leasing standards issued. The GASB establishes accounting and financial reporting standards for US state and local governments that follow generally accepted accounting principles (GAAP. This Statement establishes standards of accounting and financial reporting by state and local governmental entities for operating leases with scheduled rent. Leases - New Requirements The Governmental Accounting Standards Board has issued Statement No. 87, Leases (GASB 87), which establishes a single model for. The GASB 87 Section 8 standard excludes software. However, contracts may contain an embedded lease of physical computer equipment, which is subject to GASB

Define Gross Profit

Gross profit is the direct profit left over after deducting the cost of goods sold, or cost of sales, from sales revenue. It's used to calculate the gross. The gross profit margin is the ratio of gross profit to net revenue, expressed as a percentage. The gross profit is equal to net revenue minus the cost of. The gross profit meaning is the profit a company makes after deducting the costs associated with making and selling its products or services. Gross margin is the percentage of a company's revenue that it keeps after subtracting direct expenses such as labor and materials. You are a baker. · Your gross margin is calculated as a percentage of how much your sales revenue exceeds the total cost of making the sale. · The short answer? gross profit in Retail A company's gross profit is the difference between its total income from sales and its total production costs. Gross profit is the. Gross profit is the amount a company has remaining after deducting costs related to manufacturing and selling of products and services. In short, gross profit is your revenue without subtracting your manufacturing or production expenses, while net profit is your gross profit minus the cost of. Gross profit is the money you have left after paying for the things you sold to customers. Gross profit is the direct profit left over after deducting the cost of goods sold, or cost of sales, from sales revenue. It's used to calculate the gross. The gross profit margin is the ratio of gross profit to net revenue, expressed as a percentage. The gross profit is equal to net revenue minus the cost of. The gross profit meaning is the profit a company makes after deducting the costs associated with making and selling its products or services. Gross margin is the percentage of a company's revenue that it keeps after subtracting direct expenses such as labor and materials. You are a baker. · Your gross margin is calculated as a percentage of how much your sales revenue exceeds the total cost of making the sale. · The short answer? gross profit in Retail A company's gross profit is the difference between its total income from sales and its total production costs. Gross profit is the. Gross profit is the amount a company has remaining after deducting costs related to manufacturing and selling of products and services. In short, gross profit is your revenue without subtracting your manufacturing or production expenses, while net profit is your gross profit minus the cost of. Gross profit is the money you have left after paying for the things you sold to customers.

Gross profit is a company's total sales after deducting the costs associated with selling its products and/or services. More In File Adjusted gross income, also known as (AGI), is defined as total income minus deductions, or "adjustments" to income that you are eligible to take. It's a financial indicator highlighting the difference between a company's total revenue and the cost of goods sold (COGS). What is Gross Profit? Gross profit, also sometimes termed gross sales, is the money left over after deducting the cost of goods sold (COGS) from revenue. In. Gross profit is the difference between your net sales and your costs of sales. Learn how it measures your company's financial efficiency and profitability. gross profit (gross margin; gross profit margin) The difference between the sales revenue of a business and the *cost of sales. It does not include the costs. What is gross profit? Gross profit on a product is the selling price of your product minus the cost of producing it. For a service business, it's the selling. Gross profit is determined by deducting the cost of goods sold (COGS) from business income. Get the complete gross profit definition here. Gross profit is a business's income from sales minus those of its day-to-day outgoings that relate directly to making sales. These outgoings are sometimes. Gross profit is the profit a company makes after deducting the direct costs associated with providing a product or service. For households and individuals, gross income is the sum of all wages, salaries, profits, interest payments, rents, and other forms of earnings. Gross profit takes all income and total cost of goods sold/revenue into account, while net profit measures all income and expenses of a business. That means. Gross Profit Example. Suppose company A has a total revenue number of $50, The costs associated with producing its products are: To get the COGS total. What is gross profit? Gross profit is the profit you make by selling your goods or services, after deducting the cost of goods sold. Cost of goods sold (GOGS). What is a good gross profit margin ratio? On the face of it, a gross profit margin ratio of 50 to 70% would be considered healthy, and it would be for many. Gross margin and Gross profit are two related metrics that are critical for understanding your business. What is gross profit percentage? It's a financial measurement that shows the percentage of revenue that exceeds the cost of goods sold (COGS). It is calculated. Gross profit measures the difference between revenue and cost of goods sold (COGS) and is considered one of the best measures of business profitability. GROSS PROFIT definition: a company's profit from selling goods or services before costs not directly related to producing. Learn more.

Best Non Government Student Loans

Nelnet: Best for competitive rates · College Ave: Best for graduate students · Custom Choice: Best for discounts and rewards · Ascent: Best for no-cosigner loans. Brazos is a non-profit lender offering educational funding through private student loans available only to Texas Residents. They offer a wide range of loan. Our experts' picks for the best student loans from reputable lenders include Ascent, Rhode Island Student Loan Authority, SoFi and five others. Federal student loans: Federal loans offer a variety of income-driven repayment (IDR) plans that base your payment on your income and household size. You could. Alternative/Private Loans. Please Note: You do not have to borrow from any of these lenders, if you wish you may use another lender that is currently not on. I used Sallie Mae when my son reached his maximum loan amount from Federal Student loans. It's a great alternative for students and parents when other. Federal student loans are almost always a better first choice than private student loans, but they have borrowing limits and qualification requirements. Private loans are offered by private lenders and there are no federal forms to complete. Some families turn to private education loans when the federal loans. Choose the #1 Private Student Loan Lender in the Nation. Applying online is easy – you could receive a credit result in about 10 minutes. Nelnet: Best for competitive rates · College Ave: Best for graduate students · Custom Choice: Best for discounts and rewards · Ascent: Best for no-cosigner loans. Brazos is a non-profit lender offering educational funding through private student loans available only to Texas Residents. They offer a wide range of loan. Our experts' picks for the best student loans from reputable lenders include Ascent, Rhode Island Student Loan Authority, SoFi and five others. Federal student loans: Federal loans offer a variety of income-driven repayment (IDR) plans that base your payment on your income and household size. You could. Alternative/Private Loans. Please Note: You do not have to borrow from any of these lenders, if you wish you may use another lender that is currently not on. I used Sallie Mae when my son reached his maximum loan amount from Federal Student loans. It's a great alternative for students and parents when other. Federal student loans are almost always a better first choice than private student loans, but they have borrowing limits and qualification requirements. Private loans are offered by private lenders and there are no federal forms to complete. Some families turn to private education loans when the federal loans. Choose the #1 Private Student Loan Lender in the Nation. Applying online is easy – you could receive a credit result in about 10 minutes.

Private student loans are credit-based loans applied for through individual banks that help students “bridge the gap” between the financial aid they have been. For private student loans, you typically shop around with banks, credit unions and online lenders to find the best overall loan offer. Unlike federal loans. While there is a great range of private educational loans available, we do not recommend alternative loans in most cases, as they do not have the beneficial. Federal student loans are made by the government, with terms and conditions that are set by law, and include many benefits (such as fixed interest rates). Best overall: College Ave; Best for low rates: Earnest; Best for parents: Sallie Mae; Best for no fees: Discover; Best for students with bad credit: Ascent. Earnest is our top pick for all-around best lender due to its unparalleled range of loan options and its low rates. However, if finding the absolute lowest. Students may choose any lender who offers alternative education loans. There are many local and regional lenders and credit unions offering private education. Compare private student loan options from the nation's best lenders like Sallie Mae, College Ave and Discover. Find competitive rates and fees. In contrast, federal student loans maintain an annual limit range of $5,$12, based on a student's undergraduate grade level. Private student loan lenders. Fund your education with flexible private loans from Earnest. Get the guidance you need with expert in-house support. No fees, ever. Featured Lenders ; College Ave · % – % ; Sallie Mae · % – % ; Custom Choice Loan · % – % ; Ascent Student Loans · % – % ; Earnest. I used Sallie Mae when my son reached his maximum loan amount from Federal Student loans. It's a great alternative for students and parents when other. Federal student loans: Best overall · SoFi: Best for member benefits · ISL: Best for no-cosigner loans · Pros · Cons · What is the best loan for a student to take. MPOWER is a student loan company that offers private loans to international students without the need for co-signer. Loans are available to undergraduate. FASTChoice is a tool for comparing a historical list of private loan lenders through which our students have borrowed during the past three award years. For most student borrowers, federal Direct loans are the better option. They almost always cost less and are easier to repay. (This may not be the case if you. On the other hand, the best student loans offered by private lenders are usually from specific student loan lenders or financial institutions. Interest rates. A Private Alternative Student Loan is a non-federal loan provided by an outside resource such as a bank or lending institution. Here are the best private student loans for financing your higher education. The top private student loans help cover the cost of college once you've exhausted. They almost always cost less and are easier to repay. (This may not be the case if you are a parent or graduate student considering federal PLUS loans, though.).

Can I Refinance My Car Loan Immediately

You can refinance your car loan as long as you meet certain requirements set by the refinancing lender. Lenders often have refinance requirements for a. If you're struggling with a high interest rate or an unaffordable monthly payment, refinancing could be the key to finding better, more favorable terms. Technically, you can refinance your car loan as soon as you can find a lender that's willing to give you a loan. However, there are some downsides to. If you're still wondering “How long can I wait to refinance my car?,” it's less about timing and more about finding the monthly payment, rate and length of the. You can refinance whenever you want; there is no mandatory waiting period. I've seen people refinance within 48 hours of purchase. Car was recently purchased. If you're thinking of refinancing your loan, consider waiting at least 6 months after the purchase of your vehicle. This allows your. While you could refinance your car almost immediately after purchase, it's best to wait at least six months to a year to give your credit score time to recover. You can refinance your car loan in 4 steps. Learn more about how to refinance your auto loan. How soon will I receive a decision after I submit my loan. How Long Should You Wait to Refinance an Auto Loan? If you're interested in car loan refinancing, you may submit an auto refi loan application with a lender. You can refinance your car loan as long as you meet certain requirements set by the refinancing lender. Lenders often have refinance requirements for a. If you're struggling with a high interest rate or an unaffordable monthly payment, refinancing could be the key to finding better, more favorable terms. Technically, you can refinance your car loan as soon as you can find a lender that's willing to give you a loan. However, there are some downsides to. If you're still wondering “How long can I wait to refinance my car?,” it's less about timing and more about finding the monthly payment, rate and length of the. You can refinance whenever you want; there is no mandatory waiting period. I've seen people refinance within 48 hours of purchase. Car was recently purchased. If you're thinking of refinancing your loan, consider waiting at least 6 months after the purchase of your vehicle. This allows your. While you could refinance your car almost immediately after purchase, it's best to wait at least six months to a year to give your credit score time to recover. You can refinance your car loan in 4 steps. Learn more about how to refinance your auto loan. How soon will I receive a decision after I submit my loan. How Long Should You Wait to Refinance an Auto Loan? If you're interested in car loan refinancing, you may submit an auto refi loan application with a lender.

Refinancing your auto loan can lower your monthly payment and save you money long term. Learn how to refinance your car and when to consider it. Can I refinance my car loan if I have negative equity in my vehicle? Negative equity, also known as being upside-down or underwater in your loan, is when you. When You Should Consider Refinancing Your Auto Loan · You Want A Better Interest Rate · You Want To Change Lenders · You Want Lower Monthly Payments · Your Current. Step 1: Pre-qualify. Submit a pre-qualification request with no impact to your credit score. · Step 2: Choose your offer and submit your credit application. If. You can typically refinance a car loan in 60 to 90 days, but it may make more sense to wait. By. Carrie Pallardy. In most cases, you can refinance a car immediately after purchasing it as long as you meet all of the qualifications. However, the best time to refinance a car. When You Should Consider Refinancing Your Auto Loan · You Want A Better Interest Rate · You Want To Change Lenders · You Want Lower Monthly Payments · Your Current. Get pre-qualified for an auto refinance loan instantly with just a few questions. You'll immediately see what rate you may be eligible for, without a hit to. If your current credit score is higher than it was when you bought your car, refinancing could be a good option. Ask your lender to consider giving you a lower. Apply online today to refinance your existing auto loan and you may be able to lower your monthly payments. If you are immediately tempted to shop for a refinance, check your credit first. It might be worth waiting a few months to let your score recover. Another. Refinancing your auto loan so you have a lower monthly payment can make sense if your income has dipped. The lower payment can help ease the strain on your. Refinancing a car involves taking out a new auto loan and using it to pay off your existing loan, usually to secure a better interest rate or other. Paying off your existing car loan and refinancing it into a new one could help you save money by scoring a lower interest rate. Apply today. You can refinance your car loan if you're not happy with the current monthly car payment or loan terms. Here's what you need to know. Step 1: Pre-qualify. Submit a pre-qualification request with no impact to your credit score. · Step 2: Choose your offer and submit your credit application. If. Current car loan details. The time it takes to review your refinancing application depends on the provider. Some can do it almost immediately. Others may take. Refinance your auto loan and lower your rates. Get pre-qualified online in minutes, with no impact on your credit score. Find out how much you could save! If you're considering refinancing your car loan, you could get a lower rate and lower monthly payments by refinancing with Navy Federal. It's fast and easy to. A fast and easy application process with check delivered as soon as the next business day. How much could my auto loan payments.

Zebpay

ZebPay is a global crypto asset exchange founded in India and based in Singapore. It has offices in Australia and provides online services globally in Zebpay is a cryptocurrency company founded in by Sandeep Goenka, Saurabh Agrawal and Mahin Gupta. Indian Bitcoin Startup Zebpay Raises $1 Million. A bitcoin wallet startup based in India has raised $1m in Series A funding from a group of angel investors. Zebpay logo. Zebpay. 0 followers. Follow. Global Cryptocurrency Exchange and Wallet. Industries. Apps, Blockchain. +4. Headquarters. Malta, Latvia. Stage. See how Zebpay compares to similar products. Zebpay's top competitors include CoinDCX, and WazirX. CoinDCX Logo CoinDCX Unclaimed. Zebpay is a company that operates in the cryptocurrency exchange industry. It offers services that allow users to buy, sell, and trade a wide range of. ZebPay makes trading and investing in crypto assets simple and secure. Established in , we're a leading crypto trading exchange with more than 7 million. You'll report your ZebPay gains or income in your Income Tax Return. Any gains should be reported in Schedule VDA and any income from crypto should be reported. Founded in India in , Zebpay is a pioneering cryptocurrency exchange platform, with headquarters in Singapore and growing global popularity. The company has. ZebPay is a global crypto asset exchange founded in India and based in Singapore. It has offices in Australia and provides online services globally in Zebpay is a cryptocurrency company founded in by Sandeep Goenka, Saurabh Agrawal and Mahin Gupta. Indian Bitcoin Startup Zebpay Raises $1 Million. A bitcoin wallet startup based in India has raised $1m in Series A funding from a group of angel investors. Zebpay logo. Zebpay. 0 followers. Follow. Global Cryptocurrency Exchange and Wallet. Industries. Apps, Blockchain. +4. Headquarters. Malta, Latvia. Stage. See how Zebpay compares to similar products. Zebpay's top competitors include CoinDCX, and WazirX. CoinDCX Logo CoinDCX Unclaimed. Zebpay is a company that operates in the cryptocurrency exchange industry. It offers services that allow users to buy, sell, and trade a wide range of. ZebPay makes trading and investing in crypto assets simple and secure. Established in , we're a leading crypto trading exchange with more than 7 million. You'll report your ZebPay gains or income in your Income Tax Return. Any gains should be reported in Schedule VDA and any income from crypto should be reported. Founded in India in , Zebpay is a pioneering cryptocurrency exchange platform, with headquarters in Singapore and growing global popularity. The company has.

ZebPay Exchange Overview. ZebPay is a Centralized exchange that ranks # on BitDegree Exchange Tracker. ZebPay has a trading volume of $, in the last Official ZebPay support. We will never ask you to DM us, transfer funds to any address or share personal details except via a support ticket on http://help. Get all latest & breaking news on Zebpay. Watch videos, top stories and articles on Zebpay at p2p-zaim.ru Explore now - p2p-zaim.ru #ZebPay #CryptoMeinPro #QuickTrade #CryptoTrading #CryptoInvestor #Bitcoin #BTC #BTCetf Introducing. ZebPay is the easiest way to invest and trade in Bitcoin in over countries across the globe. The choice of 3 million traders worldwide, the ZebPay app for. Location: Durham · + connections on LinkedIn. View Rahul (ZebPay) Pagidipati's profile on LinkedIn, a professional community of 1 billion members. ZebPay is India's oldest and most widely used cryptocurrency exchange with a simple, secure and safe platform to buy, sell, lend, and earn returns for. Zebpay is a company that operates in the cryptocurrency exchange industry. It offers services that allow users to buy, sell, and trade a wide range of. You can generate your gains, losses, and income tax reports from your Zebpay investing activity by connecting your account with CoinLedger. Start your crypto journey with ZebPay today! Get the ZebPay app here: p2p-zaim.ru Stay tuned for updates! ZebPay is a crypto-assets exchange with an established presence in India, Australia and Singapore. Since its inception in in India, ZebPay has rapidly. ZebPay's focus is on supporting all types of users in their learning and growth within the crypto platform. The user experience is designed to better understand. How many stars would you give Zebpay? Join the 49 people who've already contributed. Your experience matters. About ZebPay ZebPay makes trading and investing in crypto assets simple and secure. Established in , we're a leading crypto trading exchange with more. Read writing from Zebpay on Medium. Instant Buy/Sell with Zebpay at p2p-zaim.ru Start buying & selling cryptos! Zebpay is complete fraud. They are deducting your purchased coins in the name of inactive account fee. My thousand of rupess are wiped out. Please do not trust. ZebPay is a crypto exchange platform that first marked its presence in October with the launch of Bitcoin wallet in India. Zebpay - Check crypto exchnage platform Zebpay news, latest updates, valuation and more on The Economic Times. Check everything you need to know about. CoinTracker imports your Zebpay transactions to make tracking your balances, transactions and crypto taxes easy. Integration icon. Importing.

Top 10 Secured Credit Cards

Secured credit cards ; OpenSky® Secured Credit Visa® Card · reviews · %* Variable ; First Progress Platinum Select Mastercard® Secured Credit Card · With the Discover it® Secured Credit Card, you provide a refundable security deposit to back your credit line. You still make monthly payments, and can build. + Show Summary · Capital One Platinum Secured Credit Card · Chime Credit Builder Secured Visa® Credit Card · Discover it® Secured Credit Card · Capital One. A secured credit card is one of the best ways to build or improve credit. Learn more about what it is and how it works here. Citi® Secured Mastercard® · Citi® Secured Mastercard® · Discover it® Secured Credit Card · Capital One Platinum Secured Credit Card · U.S. Bank Secured Visa® Card. Pay on time and avoid late fees by selecting an automatic payment option that best suits your budget. ID Navigator Powered by NortonLifeLock ™. Get tools that. + Show Summary · Capital One Platinum Secured Credit Card · Chime Credit Builder Secured Visa® Credit Card · Discover it® Secured Credit Card · Capital One. Best Secured Credit Cards with No Annual Fee · U.S. Bank Cash+® Visa® Secured Card · Bank of America® Travel Rewards Secured Credit Card · Capital One Quicksilver. Best Credit Cards: Best Secured Credit Cards in ; Neo Secured Credit Card · Neo Secured Credit Card. Finly Rating ; Capital One Secured Mastercard. Secured credit cards ; OpenSky® Secured Credit Visa® Card · reviews · %* Variable ; First Progress Platinum Select Mastercard® Secured Credit Card · With the Discover it® Secured Credit Card, you provide a refundable security deposit to back your credit line. You still make monthly payments, and can build. + Show Summary · Capital One Platinum Secured Credit Card · Chime Credit Builder Secured Visa® Credit Card · Discover it® Secured Credit Card · Capital One. A secured credit card is one of the best ways to build or improve credit. Learn more about what it is and how it works here. Citi® Secured Mastercard® · Citi® Secured Mastercard® · Discover it® Secured Credit Card · Capital One Platinum Secured Credit Card · U.S. Bank Secured Visa® Card. Pay on time and avoid late fees by selecting an automatic payment option that best suits your budget. ID Navigator Powered by NortonLifeLock ™. Get tools that. + Show Summary · Capital One Platinum Secured Credit Card · Chime Credit Builder Secured Visa® Credit Card · Discover it® Secured Credit Card · Capital One. Best Secured Credit Cards with No Annual Fee · U.S. Bank Cash+® Visa® Secured Card · Bank of America® Travel Rewards Secured Credit Card · Capital One Quicksilver. Best Credit Cards: Best Secured Credit Cards in ; Neo Secured Credit Card · Neo Secured Credit Card. Finly Rating ; Capital One Secured Mastercard.

Top 10 Secured Credit Cards · Capital One Secured Credit Card · Citi Secured MasterCard · Digital Federal Credit Union Secured · U.S. Bank Secured Visa · Wells Fargo. This isn't the case with the First Progress Platinum Prestige Mastercard Secured Credit Card, as it offers one of the lowest variable interest rates among. Best Secured Credit Card for Rewards. Discover it® Secured. Read more. The card offers a credit limit of up to 85% of the amount deposited in the FD account. Features of SBI Advantage Plus Card. Extended credit allows the. OpenSky® Secured Credit Visa® Card · reviews · %* Variable. Annual fee. $ Rewards rate. 10%. Cash back ; First Progress Platinum Select Mastercard®. Discover it® Secured Credit Card · Capital One Quicksilver Secured Cash Rewards Credit Card · Capital One Platinum Secured Credit Card · Citi® Secured Mastercard®. Pay on time and avoid late fees by selecting an automatic payment option that best suits your budget. ID Navigator Powered by NortonLifeLock ™. Get tools that. Best Secured Credit Card for Building Credit in ; WINNER. Neo Secured Credit. $ ; Runner-up. No-Fee Home Trust Secured Visa* Card. $0 ; Runner-up. Home. Visa Credit Cards · Wells Fargo Active Cash® Card · Chase Freedom Unlimited® · Self - Credit Builder Account with Secured Visa® Credit Card · Wells Fargo Reflect®. Anyone can apply for a secured credit card, but it's best for people with little to no credit history. It may take up to business days to post. If you go Capital One, go Quicksilver secured as it at least earns %. The Platinum has no rewards and 30% APR. Explore Capital One Platinum Secured card benefits · Account Alerts. Set up personalized email or text reminders to help you stay on top of your account. Credit Card, Regular APR, Rewards, Annual Fee, Cash Limit ; Valley Visa Secured Business Credit Card, % to %, 1% unlimited cash back, None ; Bank of. Citi Secured Card: Good for Beginners, But Don't Expect Grow. 3. rated 3 out Cash advance fee — either $10 or 5% of the amount of each cash advance. Build Your Credit with a Secured Credit Card · Capital One Quicksilver Secured Cash Rewards Credit Card · secured Self Visa Credit Card · Chime Secured Credit. Best Secured Credit Cards to Rebuild Credit in · 1. First Progress Platinum Elite Mastercard® Secured Credit Card · 2. First Progress Platinum Prestige. best for you—from $–$5,, subject to credit approval; Graduate to an unsecured card. If you use and maintain the card and keep it in good $10 or 5% of. BankAmericard® Secured Credit Card BankAmericard secured credit card Allways Rewards Visa card. Winner: Best Airline Credit Card, USA Today's 10Best Readers. The Chime Credit Builder Visa card is good for those who want to build credit but don't want to be bound by minimum deposits. Annual Fee, None. Security deposit. Apply for a Secured Card — Over 1 Million Cardholders Have Used OpenSky Secured Credit Card To Improve Their Credit. The easy way to build credit.

How Much Does A Invisalign Retainer Cost

How Much Do Vivera Retainers Cost? Vivera retainers offer an affordable vivera retainer cost, ranging from $ to $1, This price includes four sets of top-. How Much Do Invisalign Retainers Cost? The cost of Invisalign retainers can vary, but they generally range from a few hundred to a few thousand dollars. In-house made retainers would be even more expensive. "Without xxx insurance, each new in house retainer would cost approximately $ If you have already completed your course of treatment, it is crucial for you to wear your retainer to maintain the final position of your teeth. There are. Every case is different, so ask your doctor if you need retainers. How much do Vivera retainers cost? Contact your doctor for more information on Vivera. The retainers can be fixed onto the position or removed whenever liked. The cost for a single retainer is between $$ and these should be worn daily for a. Generally speaking, you should expect your costs to be between $2, and $7, for Invisalign treatment. This article explains Invisalign treatment in easy-to. Removable retainers range in cost from $0-$, depending on which material you select and whether they are being replaced or not. Advanced cases can cost anywhere between $5, and $6, Do Invisalign Costs Cover Post-Treatment? Some basic cases with minimal alterations may not require. How Much Do Vivera Retainers Cost? Vivera retainers offer an affordable vivera retainer cost, ranging from $ to $1, This price includes four sets of top-. How Much Do Invisalign Retainers Cost? The cost of Invisalign retainers can vary, but they generally range from a few hundred to a few thousand dollars. In-house made retainers would be even more expensive. "Without xxx insurance, each new in house retainer would cost approximately $ If you have already completed your course of treatment, it is crucial for you to wear your retainer to maintain the final position of your teeth. There are. Every case is different, so ask your doctor if you need retainers. How much do Vivera retainers cost? Contact your doctor for more information on Vivera. The retainers can be fixed onto the position or removed whenever liked. The cost for a single retainer is between $$ and these should be worn daily for a. Generally speaking, you should expect your costs to be between $2, and $7, for Invisalign treatment. This article explains Invisalign treatment in easy-to. Removable retainers range in cost from $0-$, depending on which material you select and whether they are being replaced or not. Advanced cases can cost anywhere between $5, and $6, Do Invisalign Costs Cover Post-Treatment? Some basic cases with minimal alterations may not require.

The cost for retainers is between $1, and $2, NOTE: Our Hardy Orthodontics office located at Lakewood Colorado, has free consultation and x-rays, which. Average Costs of Traditional Braces: $5, – $10, (Yes, Invisalign treatment is essentially the same price as braces today!) Cost of Invisalign Aligners at. In the United States, average Invisalign costs range from $3, to $8, We did warn you. At $3,, you are looking at cases with minor corrections. On average, clear aligners (Invisalign cost) will range in cost from $ to $10, across the United States. Conventional braces cost is often similar to. The cost of Invisalign treatment is comparable to the cost of braces. Your doctor will determine the cost of your treatment based on how complex your case is. For Vivera (Invisalign brand) the typical cost is $ for a set of 4 in the US. I got a set of 4 for that price in February this year from an. How Much Do Invisalign Retainers Cost? Depending on where you purchase your Vivera™ Invisalign retainers, they will cost between $ and $1, However. Vivera retainers usually start at around $ I haven't seen or heard of them being priced lower. Of course, the cost depends on your. Generally, you are looking to spend somewhere between £ to £ for one pair of Invisalign retainers. When do I get Retainers after removing braces? Typically, a permanent or bonded retainer costs somewhere around $ The cost of initial placement is usually included in the cost of your overall treatment. Our charge at Sachar Dental NYC is $ each. Does dental insurance cover the cost of my retainer? Most PPO dental insurances will. Invisalign Retainers: Keep Your Perfect Smiles For Life · Keeping gaps closed · Maintaining bite correction · Preventing teeth from crowding · Preventing grinding. Typically, prices range from $3, to $8, or higher. Mean Invisalign Treatment Expenses in the United States. The Invisalign cost varies depending on the. Advanced cases can cost anywhere between $5, and $6, Do Invisalign Costs Cover Post-Treatment? Some basic cases with minimal alterations may not require. How much do Invisalign aligners cost? At Tend, Invisalign aligners cost $6, That's significantly less expensive than at other top dentist and orthodontist. How Much Do Vivera Retainers Cost in New York, NY? Vivera retainers typically come in packs of four and should be changed as per Dr. Chern's recommendation. Invisalign orthodontic treatment. Invisalign Costs. The price of Invisalign treatment varies widely but is generally comparable to traditional braces. Costs. When to Visit the Orthodontist Near Me for help with your Retainer Replacements; Taking Good Care of your Replacement Retainer; How many hours a day do I have. These aligners typically cost between $ and $ per retainer. Payment Options. Is Invisalign Covered by Insurance? Most insurance plans do cover the cost of. Vivera retainers: $ (3 sets); Hawley retainers: $ (1 set). Cost of Invisalign for Students and NSF.